Metro Atlanta Has a Housing Problem

Mortgage interest rates are up. Home prices are up. Inflation is up.

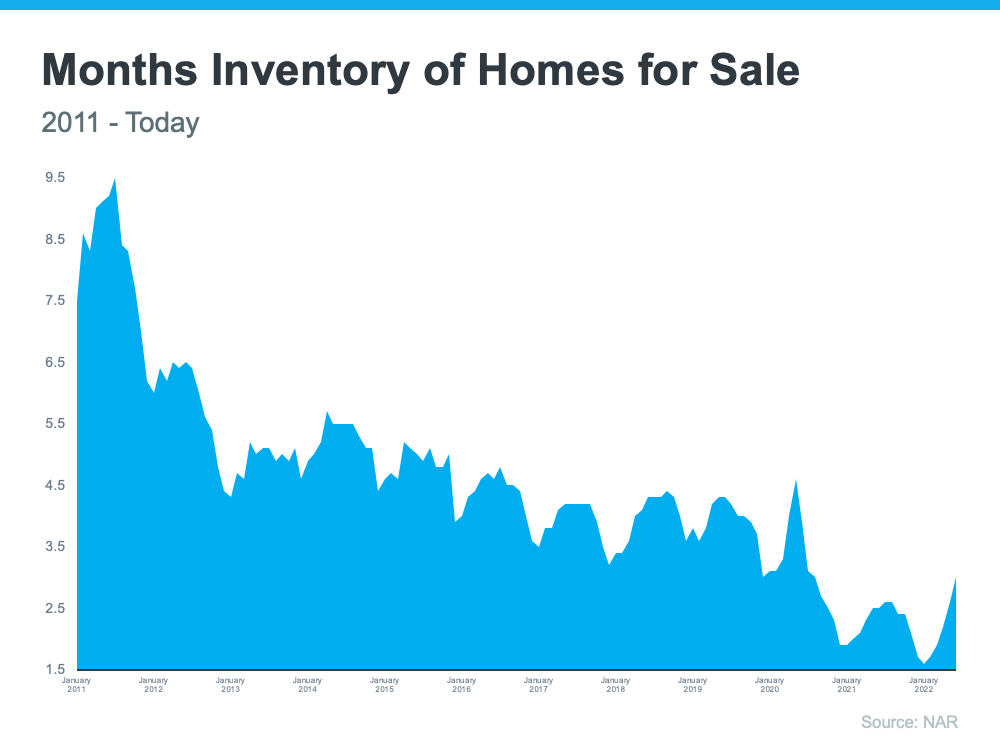

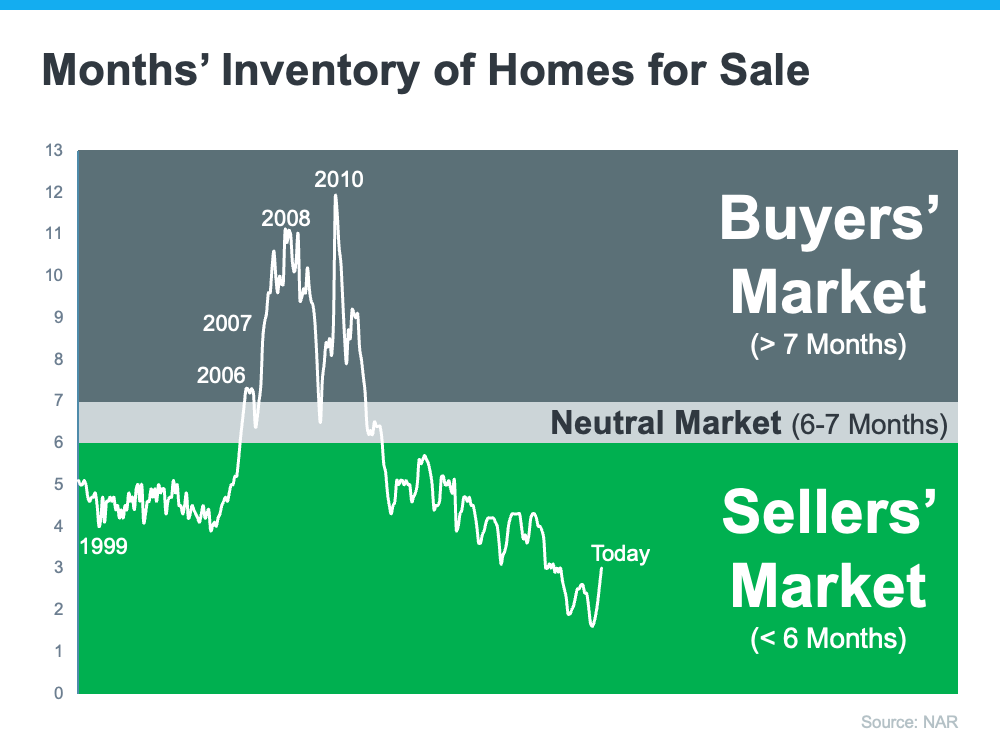

Although the current economic outlook isn’t the best, the demand for housing remains strong. While more houses are available in the post-coronavirus economy compared one and two years ago, the inventory of available homes remains historically low here in the Atlanta region.

Now new home builders are cutting back on their new home construction efforts. The cost of material and labor has caused new home housing prices to skyrocket. Higher mortgage interest rates have priced out many home buyers from new homes.

I recently commented on a post from the National Association of Home Builders on LinkedIn about the reduction of new home construction.

It is still a seller’s market. There are more buyers than sellers. There simply is not enough inventory of homes to meet the demand.

Our Solution

The reduction of new home construction is fueling demand for fully renovated homes. This is especially true for homes at or below the median price point. These are homes that are more affordable and in the most demand. First time home buyers typically look for houses to purchase that are priced below the median price.

Fixing and flipping single family houses is part of the solution to the lack home available for sale. While housing inventory is historically low, the demand for fully renovated homes in like-new condition remains high.

The cost of renovating a house with deferred maintenance and outdated features is less than the cost of building a new home. A fully renovated house will always have a lower sale price than a newly constructed home.

This is why fixing and flipping single family house is profitable.

The Opportunity: High Demand and Less Competition

As the housing market cools down from an overheated market to a stabilized, seller’s market, The opportunity to re-sell fully renovated, like-new homes is likely to remain strong while inventory stays low and home builders reduce the rate new home construction.

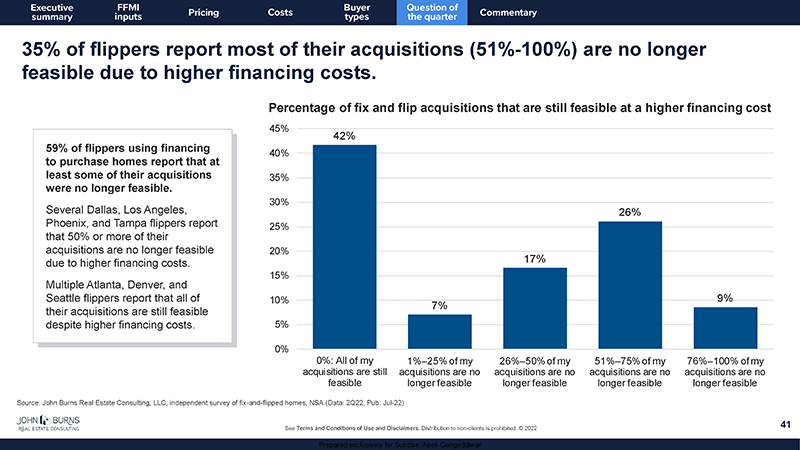

Additionally, there is less competition from other fix and flip investors because of the higher cost of financing. Investment rehabilitation loans have higher costs and interest rates. These higher costs, knock some investors out of the business of fixing and flipping homes. This has created a better environment for true cash buyers.

We anticipate the market to be optimal for fixing and flipping single family houses for some time. Having access to equity capital enables us to take advantage of this opportunity to reap profitable rewards on our deals.

Learn More

Schedule an appointment to speak with John Marion about the advantage of Alpha Dog Capital opportunities.

https://calendly.com/johnmarion/alpha-dog-capital-intro-call

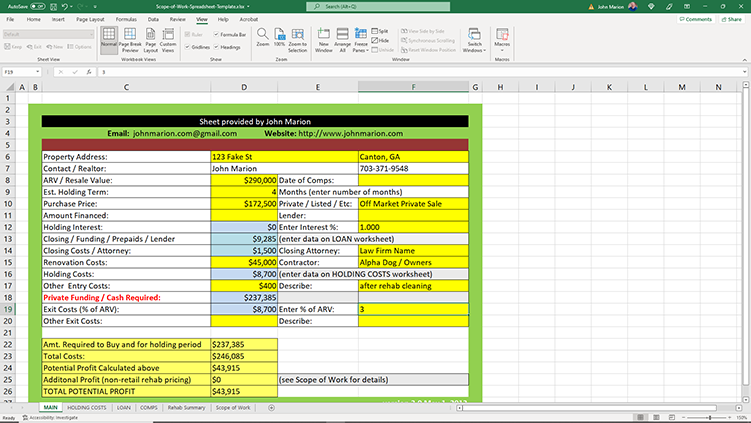

Fix and Flip Profits

Build wealth by passively investing in single-family house projects

How To Get Started

Sign Up

The first step to invest with us is to fill out our Interest Form. We'll connect and discuss your goals, then we'll find the best investments to help you meet these goals.

Invest and Enjoy

After you invest you can just sit back, relax, and receive quarterly cash flow payments from your passive investments.