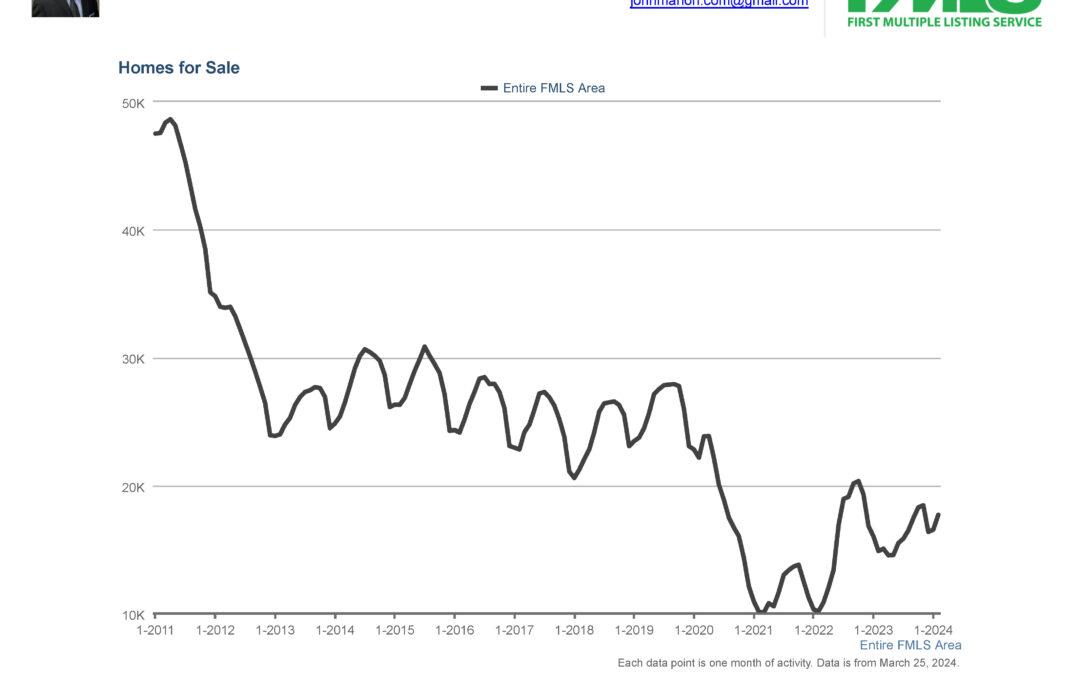

Home Sales Volume in Metro Atlanta

Looking at the past 13 years of home sales volume in metro Atlanta, the number of home sales each year since 2020 has remained historically low. Here is how this market condition can be an advantage for professional investors.

Professional Fix and Flip Investors

Professional investors who specialize in fixing and flipping single-family houses can find unexpected advantages in a market characterized by low sales volume. In such scenarios, competition dwindles as fewer buyers enter the market, enabling investors to negotiate more favorable deals with motivated sellers. With fewer properties changing hands, those investors with the financial means and strategic vision can capitalize on distressed properties that may have otherwise gone unnoticed in a more bustling market. Moreover, low sales volume is perceived as a market with decreasing property values, presenting opportunities to acquire assets at a lower cost and maximize potential profits upon resale.

Additionally, in a market with low sales volume, professional fix-and-flip investors can benefit from reduced competition during the renovation process. With fewer properties being flipped concurrently, there’s less pressure on contractors and suppliers, potentially leading to lower labor and material costs. Moreover, investors may have more flexibility in scheduling renovations and inspections, allowing for a more thorough and deliberate approach to enhancing the property’s value. Ultimately, the combination of favorable purchasing conditions and decreased competition can position professional fix-and-flip investors to achieve greater returns on their investments in a market characterized by low sales volume.

Metro Atlanta Low Inventory and Home Sales Volume

Moreover, when low sales volume coincides with a low inventory of homes for sale, professional fix-and-flip investors are presented with an even more advantageous landscape. With fewer properties available on the market, the demand for quality housing remains high, driving up the potential resale value of renovated homes. This scarcity can create a sense of urgency among potential buyers, further increasing the likelihood of a quick and profitable sale for investors. Additionally, the limited availability of homes for sale may prompt sellers to be more receptive to offers from investors, increasing the chances of securing properties at a lower price point. In essence, the convergence of low sales volume and low inventory amplifies the opportunities for professional fix-and-flip investors to thrive in their endeavors, maximizing returns and minimizing risks in the process.

Alpha Dog Capital

Contact John Marion to learn more about how we make strategic investment decisions both when we acquire and when we resell our properties.

John Marion

703-371-9548 (call or text)

Schedule a call with John on Calendly here:

https://calendly.com/johnmarion/alpha-dog-capital-intro-call