5 Due Diligence Tasks for SFH Rehab Projects. Almost every residential real estate purchase contract includes a “due diligence” period for performing inspections, etc. This is crucial anytime you are purchasing a property. However, when planning a rehab project, there are some key additional tasks you must undertake, and this is the window in which to do them.

Essentially, you must use this period to make sure the property meets the minimum investment criteria. Here are 5 important due diligence tasks.

Develop a Scope of Work

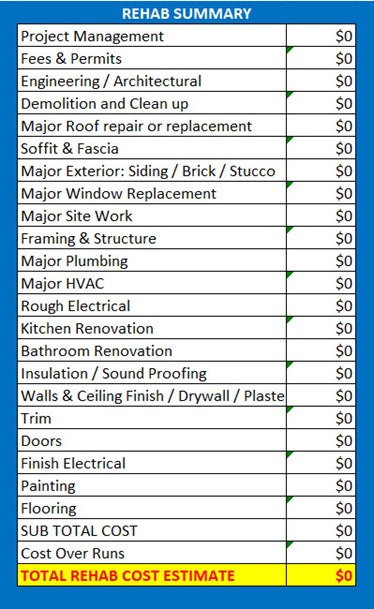

A scope of work is a line-item list of improvements that will be completed in order to bring the value of the property up to the determined re-sale price. Minimally, most properties will require minor repairs, fresh paint, and new flooring.

However, depending on the amount of deferred maintenance and damage to the property, the scope of work can vary greatly from one property to the next, from simple to highly complex. But for most single-family house renovation projects, a detailed line-item breakdown of costs for major categories of repairs and improvements is adequate.

It should be detailed enough so that the project manager understands the work to be performed. A simple scope of work summary should be created from the detailed list of line items which then can be used for quick reference during the project and for report summaries for co-investors.

Some active investors, especially those in the new home construction side of contracting, like using a highly detailed scope of work which includes specifics like the square footage of small hall closets and diagrams showing the exact placement of electrical outlets on each wall. However, this level of detail is rarely needed in most residential rehabilitation projects for houses with a resale value at or below the median price point unless you plan significant floor plan changes, electrical or plumbing remediation, etc..

Below is a sample of a scope of work summary showing the general categories in a single-family house renovation project.

Due Diligence Scope of Work Spreadsheet

To get the actual home renovation Excel spreadsheet templates for free, visit:

https://alphadogcapital.com/free-download-scope-of-work-spreadsheet/

Calculate Costs Accurately

While the Scope of Work provides a detailed list of the work to be performed on the property, understanding and calculating the cost of each line item is just as critical. Knowing the repair costs is the only way to determine if a potential deal is an actual deal.

The beginner active investor should always work on getting actual bids from licensed contractors and vendors in order to determine what the costs will be. More than one bid per line item is wise, especially for the new investor with little experience of actual, real-world pricing for typical repairs and upgrades. (Also, in a post-COVID world, costs are a lot less predictable: just because you paid $1200 for a task on your last rehab, three months ago, doesn’t mean a similar job now will price out the same.)

Most single-family house rehabilitation projects are relatively similar when it comes to the basic work that needs to be performed. Almost every project will include the same cosmetic upgrades, such as:

• fresh paint

• new flooring

• new lighting fixtures

• new finish electrical (outlets, switches, and cover plates)

• new plumbing fixtures (faucets, spigots, shower heads)

• new hardware (doorknobs, cabinet handles, hinges)

For the active investor who is continually doing renovation projects, the similarity of repair and upgrades from one project to another project enable costs to accurately be estimated prior to acquisition. This is especially true if each project falls within a similar range of square feet of living space such as 1600 – 2200 SF at or below the median resale price in the market. However, as stated above, in a post-COVID world prices may fluctuate wildly, so be diligent in getting the pricing right.

In other words, with experience and volume of projects, the repair and upgrade costs can be accurately determined for each project. The work of calculating the costs gets easier and more accurate over time for the active investor who always has at least a few deals going simultaneously.

Establish the Project Timeline

How long does it take to rehabilitate a typical 2000 square foot single family house that will re-sell at or slightly below the median price point in the market?

Getting this timeline right enables the investor to control costs by effectively managing a project from acquisition to re-sale. Most projects will fall within similar time frames. Here is the typical timeline that can be consistently repeated on most projects.

Renovation: 30 to 60 days.

Marketing: 30 to 60 days (depending on specific market conditions and seasonal variations).

Additional marketing time: 30 days (this happens when a buyer is unable to obtain their mortgage loan and the property needs to be re-listed on the market).

These timelines can be managed and although there are variables from one project to another, a typical single family house renovation project can be turned in 3 to 5 months.

It’s important to keep each project on schedule. By managing the timelines, investors can turn their money two or three times annually. Projects that are not well-managed take longer and thus reduce your opportunity to roll the money into another project sooner—which in turn leads to a reduced annualized return on investment.

By establishing the project timeline prior to acquisition, the investor knows when the exit will take place. In the event that the project includes some time-consuming upgrades—such as building additional living space and other structural items—the cost of an extended timeline can be calculated into the acquisition price and perhaps used in negotiations with the seller. In these situations, extended construction timelines can and should be calculated into the overall project costs.

Understand Alternate Exit Strategies

Prior to committing to purchase property, the active investor should understand alternate exit strategies in addition to the primary exit strategy.

When the primary exit strategy is reselling, the most likely and often used alternative exit strategy is turning the property into a rental unit. Not all single-family houses will produce positive cash flow as a rental unit. This is especially true when the resale value of a house is higher than the median or the average resale price of a house in the current local market. For this reason, it’s wise to focus on the purchase of single-family houses that will resell at or below the median or average price point.

When a single-family house is turned into a rental property, it can still be re-sold—either when the lease expires, typically one year later; or at any time, with the tenants in place, to another investment company or investor.

Another alternative exit strategy is to quickly resell the property with little or no improvements for a quick flip profit in a very short period of time. Sometimes this can take place simultaneously with the purchase through a “double closing” scenario. Additionally, the purchase contract can be assigned to another buyer for a very quick profit by collecting an assignment fee and never taking title to the property. In this case your profit is essentially a “finder’s fee” for locating an undervalued property.

Get a Complete Market Analysis

The single-family house market is always changing. Prices go up and down every month. Even in a hot market, there are typically seasonal dips in prices that occur at regular intervals year after year.

Some of these predictable fluctuations include:

• Spring is normally the highest selling volume and price point each year.

• Winter, particularly December and early January, is the slowest time and when prices drop.

• Public school breaks often mean fewer buyers are actively looking.

The active real estate investor must be aware of these market changes constantly . Not only that, but every property that you get under contract must have a complete market analysis performed during the due diligence period.

The best way to stay up to date on these changes is to get a monthly market report and a market analysis for each property being purchased. Both reports can be provided by a licensed real estate broker or agent who is active and knowledgeable in the local market.

A complete market analysis for a single-family house will show recent sales of comparable houses sold within a certain period of time. The time frame should be limited to houses sold within the past 6 months. In a hot market, houses sold in the last 2 to 4 months may have enough comparable properties (or “comps”) that reflect the most current market conditions.

The data about each comparable property sold will be included in the market analysis report. The active investor can study the report to determine what the expected resale price will be for the subject property.

In some rare cases, when market conditions are volatile or a house is situated in a unique location, it may even be a good idea to get an independent appraisal of the property. The data from the appraisal can be compared to the market analysis report in order to understand the market conditions clearly.

Because market conditions are always changing and every single-family house is unique, it is a big mistake to skip the market analysis on any property as part of the due diligence.

Once you have your market analysis completed, you should evaluate your numbers. You may need to make some adjustments to your scope of work or go back to the seller and renegotiate a better price to make the deal work for you.

Conclusion

These five due diligence tasks should become institutionalized into the work flow when buying single-family houses. Active real estate investors will need to understand each of these due diligence tasks and work with team members—such as managing partners or licensed real estate brokers and other professionals—to complete these tasks prior to committing to the purchase of any property.

How To Get Started

Sign Up

The first step to invest with us is to fill out our Interest Form. We'll connect and discuss your goals, then we'll find the best investments to help you meet these goals.

Invest and Enjoy

After you invest you can just sit back, relax, and receive quarterly cash flow payments from your passive investments.